Setting up overtime rates

Learn how to configure overtime rates and view overtime pay on timesheets

Similarly, various countries have their own specific multiplier values or scale factors that must be applied to overtime hours to adhere to labor laws and guarantee fair overtime pay. With Jibble’s employee overtime tracker, configuring overtime rates becomes a straightforward process, ensuring that employees receive fair compensation for their additional work.

This article covers:

Setting up overtime rates

Important ❗: Before configuring overtime rates, be sure that you have set a billable rate for your team members on their profile details. Read more about updating a person’s profile information.

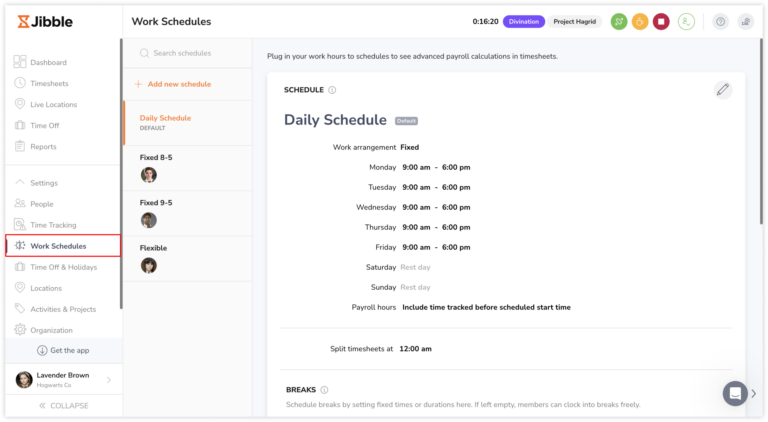

- Go to Work Schedules from the left navigation menu.

- If you haven’t already created a work schedule, you may need to do so. If you have existing work schedules, select the one to which you wish to apply overtime rates.

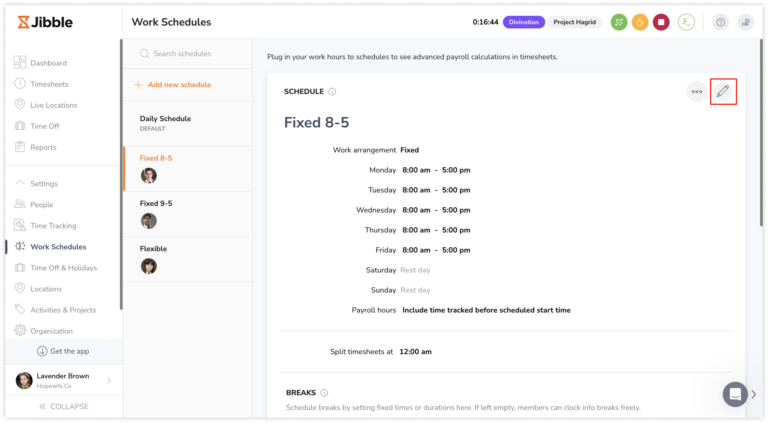

- Click on the pencil icon to access the work schedule settings.

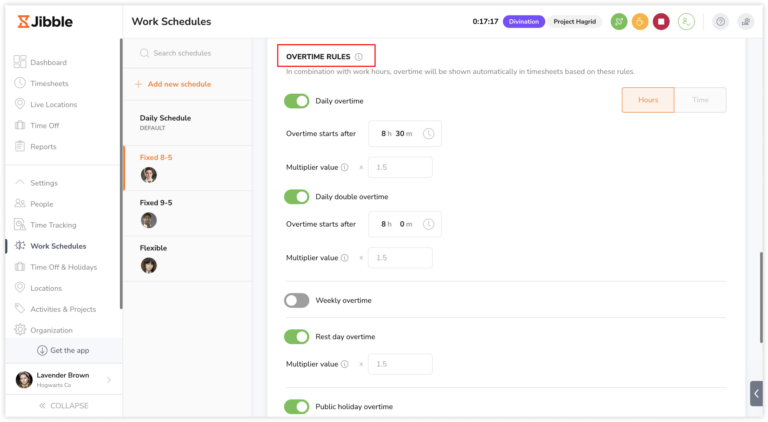

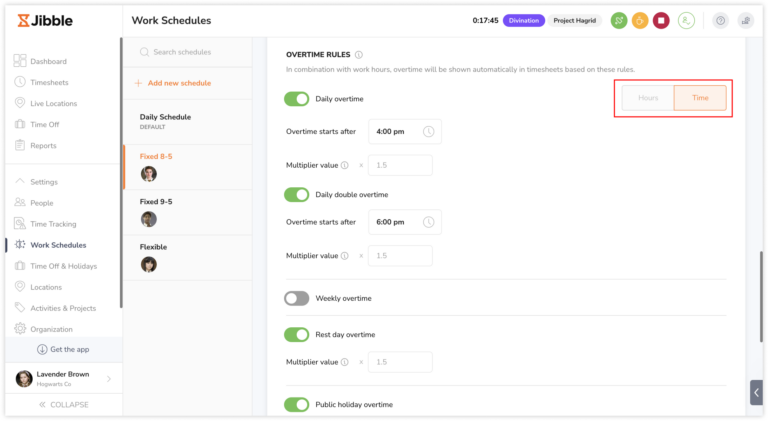

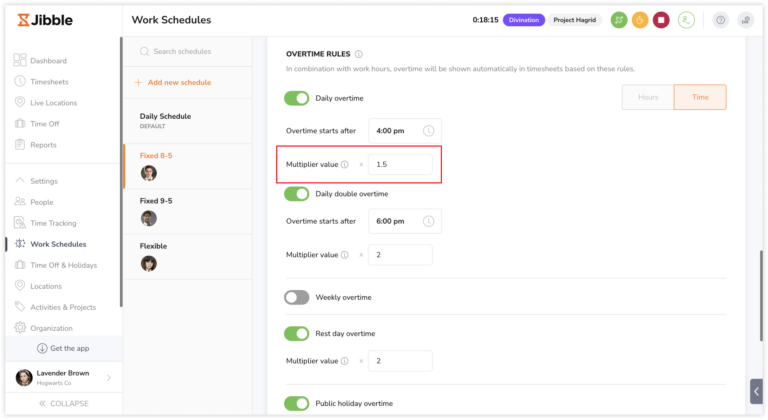

- Locate the “Overtime Rules” section.

- Enable the type of overtime(s) that align with your company’s policies. For more information on overtime rules, check out our article on how overtime works.

- Define the overtime thresholds, whether they are based on a specific time or a certain number of hours worked.

- Enter the multiplier values for each overtime rule. This value will be used to calculate overtime pay and will be applied to hours worked beyond the set threshold.

- Click the Save button to confirm your overtime settings.

Viewing overtime pay in exports

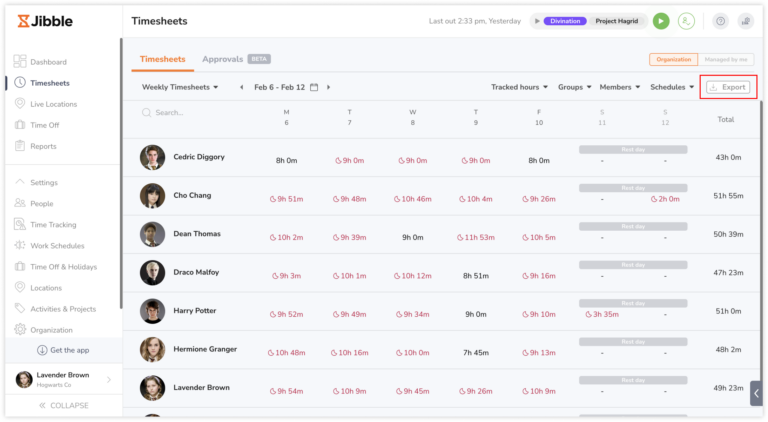

Overtime rates will contribute to the overall Billable Amount shown in timesheet exports.

Timesheet summary reports provide a comprehensive view of total overtime hours, their associated rates, and the total billable amounts for each team member.

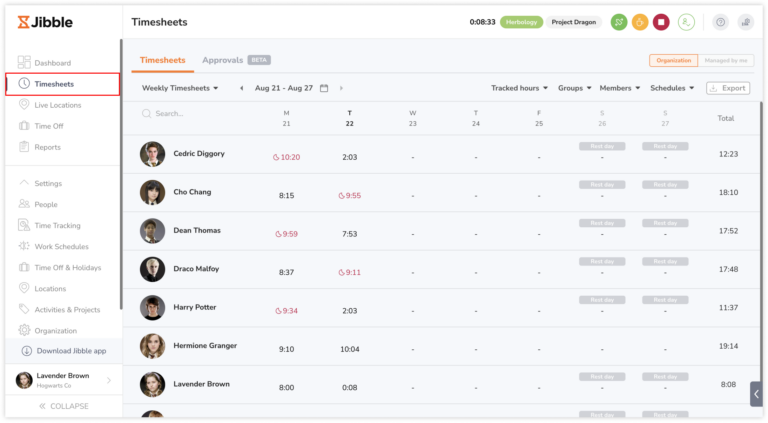

- Go to Timesheets.

- Click on the Export button.

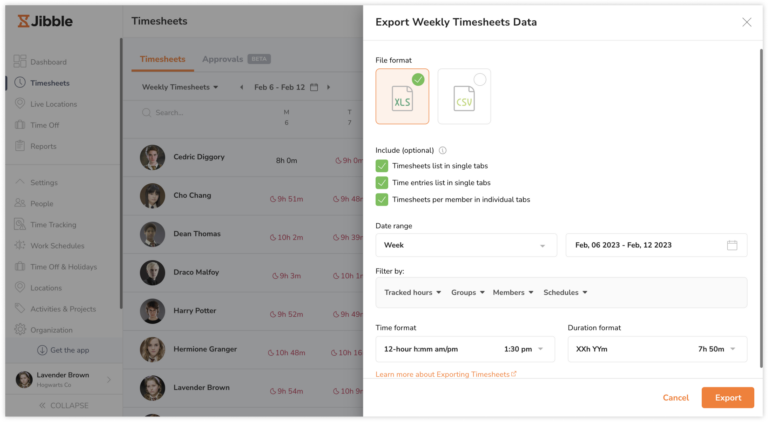

- Select a file format. This could be either CSV or XLS format.

- Tap on the checkboxes for additional files to export.

To get a better understanding of the content within these files, check out our article on the different types of reports that can be exported.

To get a better understanding of the content within these files, check out our article on the different types of reports that can be exported. - Select your preferred date range, filters, time format, and duration format for the export.

- Hit the Export button.

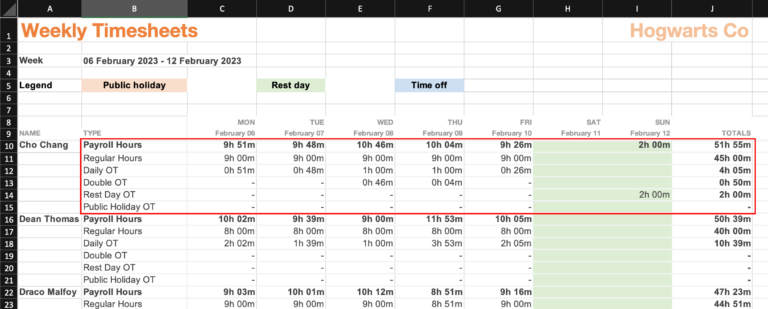

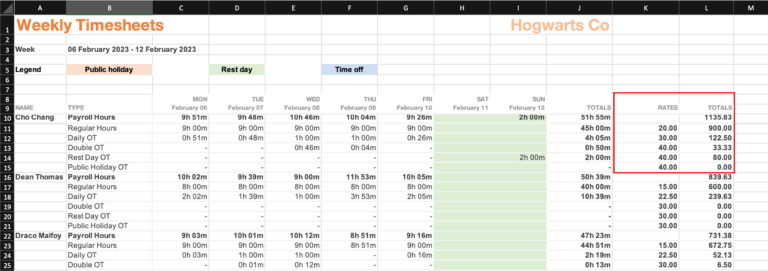

- In the exported file, you will find a breakdown of payroll hours, categorized into regular hours and overtime hours.

- Each row will display the respective hours corresponding to the type of overtime.

- At the end of the column, you will see the rates for each type of overtime, along with the total billable amounts.

Billable amounts and overtime rate calculations

Overtime pay formulas:

|

|

Formula |

|

Overtime rate |

Multiplier Value * Billable Rate |

|

Billable amount |

(Billable Rate * Regular Hours) + (Billable Rate * Paid Time Off Hours) + (Daily OT Rate * Daily OT Hours) + (Daily Double OT Rate * Daily Double OT Hours) + (Public Holiday OT Rate * Public Holiday OT Hours) + (Rest Day OT Rate * Rest Day OT Hours) |

Example 1

Let’s consider an employee named Sarah who works in a company that follows a standard 8-hour workday. The company’s policy states that any hours worked beyond 8 hours in a single workday are considered daily overtime whereas any hours worked beyond 12 hours are considered daily double overtime.

Sarah clocks in at 8am and clocks out at 10pm on Monday. Here’s how her overtime pay is calculated:

- Total Payroll Hours: 14 hours

- Regular Hours: 8 hours

- Daily Overtime Hours: 4 hours

- Daily Double Overtime Hours: 2 hours

- Billable rate: $20 per hour

- Multiplier Value: 1.5x for Daily Overtime and 2x for Daily Double Overtime

Overtime rate calculations:

- Formula for Overtime Rate: (Multiplier Value * Billable Rate)

- Daily OT Rate: 1.5 * $20 = $30

- Daily Double OT Rate: 2 * $20 = $40

Overtime pay calculations:

- Regular Pay: 8 hours * $20 = $160

- Overtime Pay:

- Daily OT: 4 hours * $30 = $120

- Daily Double OT: 2 hours * $40 = $80

- Billable Amount: $160 + $120 + $80 = $360

So, Sarah’s total billable amount for the day, including overtime, is $360.

Example 2

Now, let’s consider Frank’s work on a public holiday, which also falls on a Sunday (a Rest day). Here’s how his overtime pay is calculated:

- Payroll Hours: 8 hours

- Regular Hours: 0 hours (any time worked on a public holiday is considered as Public Holiday OT)

Note: Check out our article on how overtime works or how overtime is calculated according to the Malaysian Employment Act for a more detailed understanding of overtime calculations specific to Malaysia.

- Public Holiday Overtime Hours: 8 hours

- Rest Day Overtime Hours: 0 hours (if a Public Holiday and a Rest Day coincide on the same day, Public Holidays take precedence)

- Billable Rate: $20 per hour

- Multiplier Value: 1.5x for Public Holiday OT and 2x for Rest Day OT

Overtime rate calculations:

- Formula for Overtime Rate: (Multiplier Value * Billable Rate)

- Public Holiday OT Rate: 1.5 * $20 = $30

- Rest Day OT Rate: 0 * $20 = $0

Overtime pay calculations:

- Regular Pay: 0 hours * $20 = $0

- Overtime Pay:

- Public Holiday OT: 8 hours * $30 = $240

- Rest Day OT: 0 hours * $40 = $0

- Billable Amount: $0 + $240 + $0 = $240

In this example, for the 8 hours Frank worked on the public holiday, his total billable amount is $240.