Calculating breaks and automatic deductions

Learn how to calculate breaks and utilize automatic deductions for precise payroll calculations

This article covers:

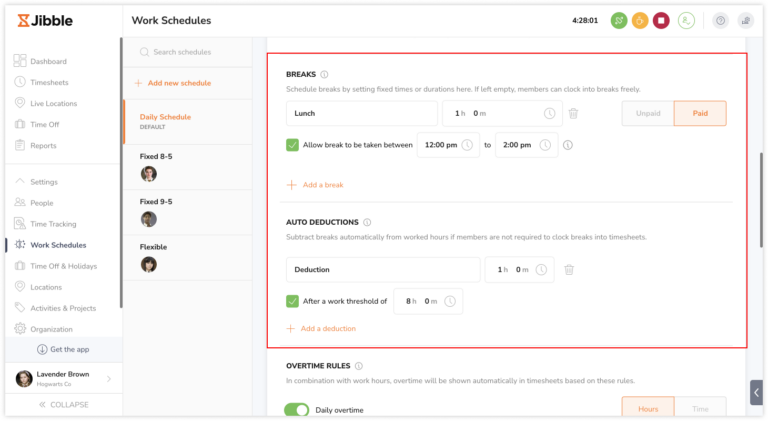

Setting up breaks and automatic deductions

Once you’ve configured your work schedule and working hours, you can proceed to set up breaks and automatic deductions.

Breaks can be customized with specified time frames and durations. When creating deductions, you can define the amount of time to deduct daily and the minimum daily threshold for the deduction to apply.

Refer to our article on managing work schedules and tracking break time for more information.

Understanding the calculation for breaks and automatic deductions

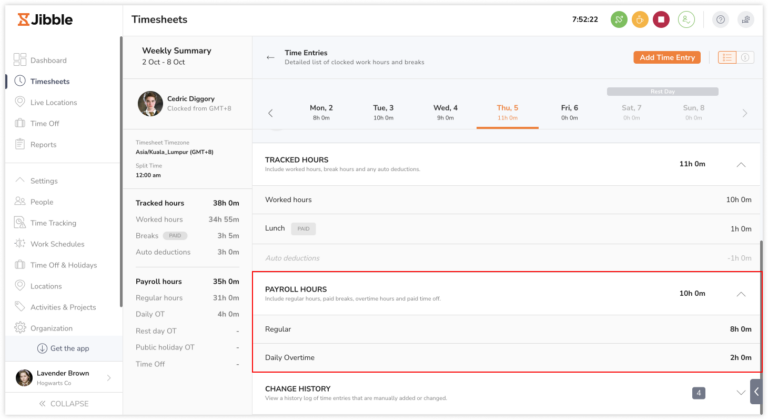

You can easily access break time and automatic deductions on an individual’s detailed timesheet.

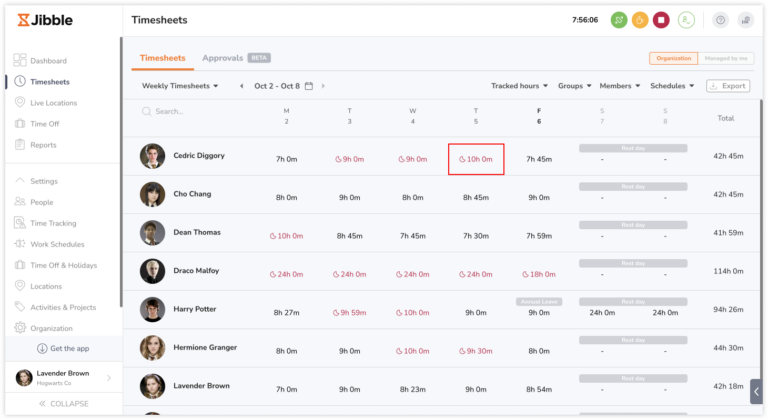

- Go to Timesheets.

- Search for a particular member and click on the hours for a specific day.

- Their detailed timesheets will be displayed.

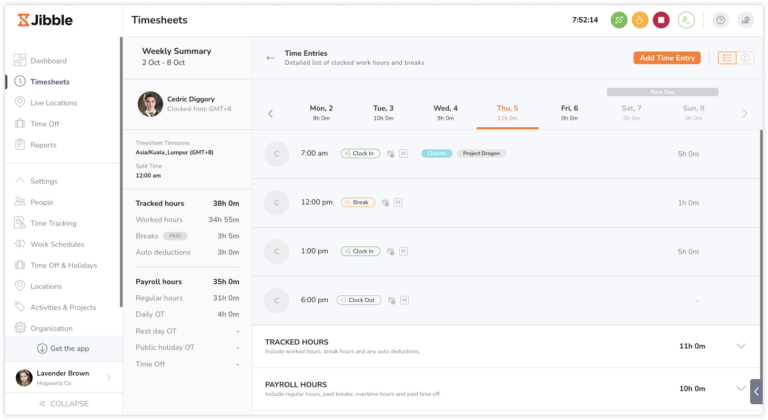

- Break entries will be indicated with a break chip on the web app and an orange circle on the mobile app.

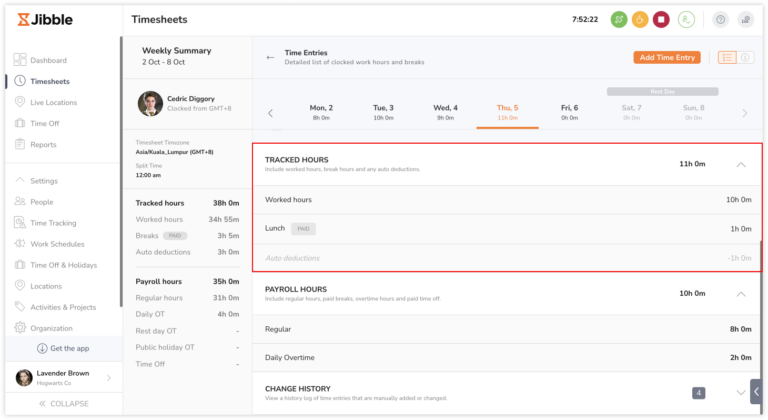

- To view automatic deductions, expand the Tracked Hours tab.

Example calculation:

Cedric’s work schedule is as below:

- Paid break: 60-minute lunch break

- Automatic deduction: 1 hour after working for 8 hours

- Daily overtime: After a threshold of 8 hours.

On the tracked hours tab of his detailed timesheets, Cedric has tracked a total of 11 hours on Monday. Tracked hours are all hours tracked in a day, including break hours. The breakdown of his tracked hours are as follows:

- Worked hours: 10 hours (all hours worked excluding breaks)

- Lunch: 1 hour (paid)

- Automatic deductions: -1 hour

As Cedric has tracked more than 8 hours on Monday, 1 hour is automatically deducted based on the predefined automatic deductions set on his work schedule.

On the payroll hours tab of his detailed timesheets, Cedric has a total of 10 payroll hours. These payroll hours are determined by distributing worked hours and paid breaks (after accounting for any automatic deductions) into two categories: regular hours and overtime hours. The breakdown of his payroll hours are as follows:

- Regular hours: 8 hours

- Daily overtime hours: 2 hours

For a more detailed explanation of tracked hours and payroll hours, check our article on the difference between tracked hours and payroll hours.